Question 1.

Draw the graph of 2x + y = 6 and 2x – y + 2 = 0. Shade the region bounded by these lines and x-axis. Find the area of the shaded region. [CBSE 2007]

Solution:

The given system of equation is

2x + y – 6 = 0 ………. (i)

2x – y + 2 = 0 ……… (ii)

solutions for each equation of the system are:

(i) ⇒ y = 6 – 2x

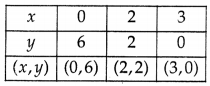

Table of solutions for 2x + y – 6 = 0

Similarly

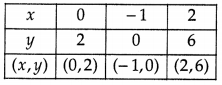

Table of solutions for 2x – y + 2 = 0

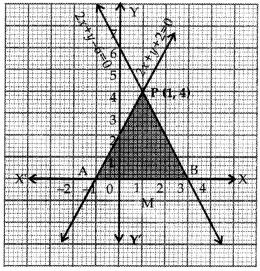

Plotting these on the graph

These intersect at (1, 4), so this is the solution.

In graph, area bounded by the lines and x-axis is

∆PAB which is shaded.

Draw PM ⊥ x-axis

PM = y-coordinate of P (1, 4) = 4 units

and AB = 1 + 3 = 4 units

∴ Area of shaded region

= Area of ∆PAB =

=