EARN MONEY BY MONEY

Here what I write or discuss is based on my experience it is not to convince anyone to follow my Strategies it is only to strengthen my belief in myself, but this may give you some idea or information because learning from others experience is best learning.

This is the requirements of always. If one wants to be rich then one must know this art. Generally people believe in saving the money while rich believe in earning more money.

People who know this art how to earn while you sleep only they become rich other people always remain poor.

It easy to earn more money by investing comparatively earning money by doing some work. To earn money by money is little easy.

Try to search where you can invest and how you can get maximum return. Generally one should try to invest in

Equity

Property

Gold

Mutual Fund

and avoid keeping the money in the banks. Bank give you less return and that is almost negative because of inflation while above mentioned items beat the inflation.

One should make the rule to save at least 10 percent of once own earning. By compounding that ten percent can be many times.

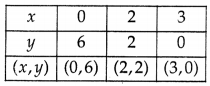

In compounding time plays big role. Investing little miney for long time is equal to investing much money for little time.

Try to save as much as possible of your earning and invest that into some mutual fund schemes. Mutual fund manager manage you money professionally and grow your money in the long time.

So invest and don't restrict your expenditures but develop extra earning sources.

If you like then share it and follow my blog.

.jpeg)