What is SWP ie Systematic Withdrawal Plan?

Answer is very common that is it is way of withdrawing money systematically. It looks easy but not very easy because many experts present this as a plan which can give you money whole life and your corpus will be intact also

Experts present this plan in very simple way that if you are getting 12℅ per annum and withdrawing just 10℅ of your accumulated corpus then your corpus will also increase at rate of 2℅ per annum and you are withdrawing 10℅ of your corpus also monthly.

I want to say that it is right but here you should take some precautions also, these are...

First don't give any command like 10℅ withdrawal every month because this strategy could deceive you also, the better way is Just withdraw your money once in a year first check how much did you get the the return and withdraw 4℅ less then your return.

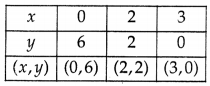

Example if you have Rs 1 lakh and got 10℅ return, it means your money will be 1 lakh 10 thousand then withdraw just Rs 6000 then you are withdrawing just 6℅ of your return, in this way your corpus will be intact and grow also,

You can withdraw money in variable manner just follow this rule first check your return and withdraw money less then your gaining amount.

Don't withdraw every month instead withdraw once in a year.

This is my way of using this SWP, just analysis yourself this strategy and if you find beneficial then follow, you can take advice of your financial advisor also.